keyboard_backspace

Let's talk about your needs

To get underway today, just click the links below.

About 1.2 million of people are currently covered by health insurance in New Zealand – almost a quarter of the entire population, estimated at 5.2 million residents. Also, $1.39 billion of claims were paid out in the 12 months to 30 June 2022, of which $347.2 million was paid in just the latest three months.

Source: Financial Services Council, Health Insurance Industry Spotlight, June 2022

It goes to show the importance of having health cover to fund healthcare costs, with many claims relating to elective treatments – which helps ease demand on the already-stretched public healthcare system.

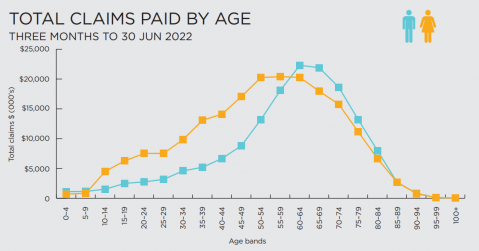

Also, unlike many people think, it’s important to note that it’s not just older Kiwis claiming on it. As the graph below shows, health insurance is already helping younger people pay for unexpected medical bills and meet their well-being needs. In fact, health issues can affect an individual at any age – and the earlier insurance is taken out, the more likely you are to be covered for any future medical conditions that may develop.

Source: Financial Services Council, Health Insurance Industry Spotlight, June 2022

If you have health insurance and would like to make the most of it, we recommend reviewing your cover regularly – ideally once a year, or even more often if your circumstances change.

Remember, health cover is not a one-size-fits-all, set-and-forget tool: as your life evolves, so may your health insurance needs. And as insurance advisers, we can help you check that your cover is still appropriate for you, or help you look at your needs and options if you’re considering getting health insurance.

Disclaimer: Please note that the content provided in this article is intended as an overview and as general information only. While care is taken to ensure accuracy and reliability, the information provided is subject to continuous change and may not reflect current developments or address your situation. Before making any decisions based on the information provided in this article, please use your discretion and seek independent guidance.

Link Financial Group Ltd trading as Mortgage Link and Insurance Link FSP 696731 holds a licence issued by the Financial Markets Authority to provide financial advice. Insurance Link (NZ) FSP 446867 is authorised by that licence to provide financial advice. Please visit www.insurancelink.co.nz/available-disclosure for more information and Disclosure information.